2025 Roth Ira Contributions. The ira contribution limits for 2025 are $6,500 for those under age 50 and $7,500 for those 50 and older. 401 (k) limit increases to $23,000 for 2025, ira limit rises to.

For 2025, the irs has raised the roth ira contribution limit to $7,000 ($8,000 for people over age 50). $6,500 per taxpayer 49 and younger.

The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

2025 Roth Limit Rory Walliw, If you qualify to tuck away money in a roth ira in 2025, you'll be able to tap into the biggest contribution limits we've ever seen. For the 2025 tax season, standard roth ira contribution limits increased from last year, with a $7,000 limit for individuals.

Roth IRA vs 401(k) A Side by Side Comparison, Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full. In 2025, you can contribute a maximum of $7,000 to a roth ira.

Roth IRA Printable Savings Tracker Retirement Fund Tracker Etsy, 2025 roth ira contribution limits and income limits. Ira account holders can contribute up to $7,000 in 2025, which is a $500 jump over the 2025 cap.

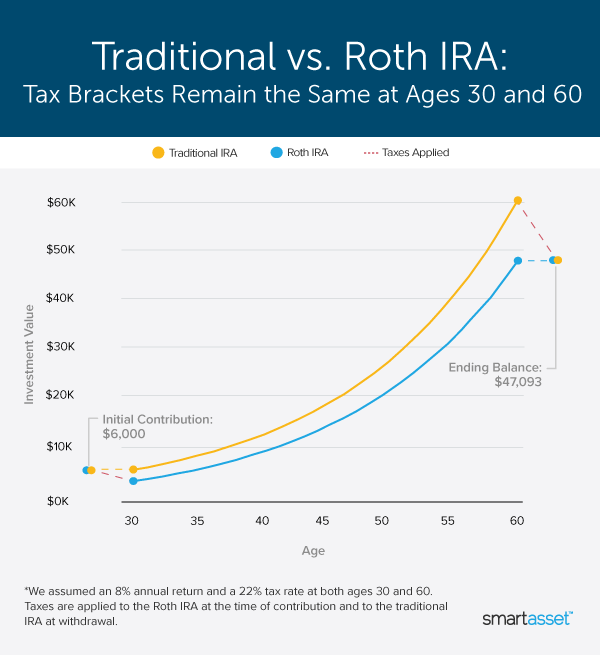

How Traditional IRAs and Roth IRAs Stack Up SmartAsset, The maximum annual contribution for 2025 is $6,500, or $7,500 if you're age 50 or older, and you can make those contributions. $7,000 if you're younger than age 50.

What is a Roth IRA? The Fancy Accountant, $6,500 per taxpayer 49 and younger. For 2025, you can contribute up to $7,000 in your ira or.

IRA Contribution Limits in 2025 Meld Financial, You can contribute a maximum of $7,000 (up from $6,500 for 2025). $8,000 if you're age 50 or older.

Roth Ira Rules What You Need To Know In 2019 Intuit Turbo —, The irs has announced the increased roth ira contribution limits for the 2025 tax year. $8,000 if you're age 50 or older.

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, 401 (k) limit increases to $23,000 for 2025, ira limit rises to. Fact checked by patrick villanova, cepf®.

Roth IRA Limits And Maximum Contribution For 2025, For 2025, you can contribute up to $7,000 in your ira or. For the 2025 tax season, standard roth ira contribution limits increased from last year, with a $7,000 limit for individuals.

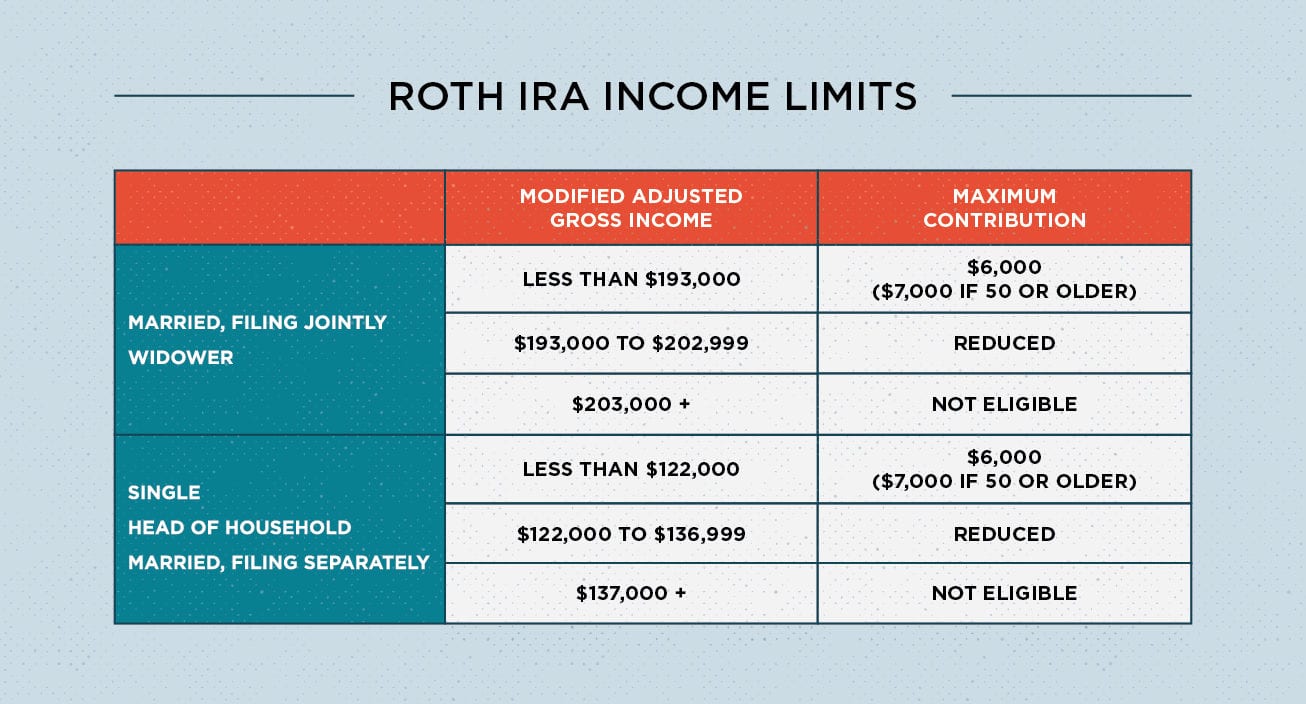

401k vs roth ira calculator Choosing Your Gold IRA, Written by lauren perez, cepf®. Roth ira contribution limits (tax year 2025) brokerage products:

For 2025, the irs has raised the roth ira contribution limit to $7,000 ($8,000 for people over age 50).